Assessment: Overview and Examples in Taxes

Taxation is an integral part of modern society, supporting public services and infrastructure. At the heart of the taxation system lies assessment, a critical process that determines how much individuals and businesses owe in taxes. But what exactly does a tax assessment involve? How is it calculated? And what are some real-life examples? This guide explores these questions in detail, providing a clear understanding of assessments and their role in the tax ecosystem.

What Is Tax Assessment?

Tax assessment refers to the systematic process by which tax authorities calculate the taxable income or value of assets for individuals or businesses. This process determines the exact tax liability based on current laws, regulations, and applicable tax rates.

Purpose of Tax Assessment

- Ensure compliance with tax laws.

- Prevent underreporting or overreporting of income.

- Provide transparency in taxation.

Tax assessment applies to various forms of taxes, including income tax, property tax, corporate tax, and sales tax, making it essential for both taxpayers and government authorities.

Key Components of a Tax Assessment

1. Taxable Income Calculation

Taxable income is determined by subtracting allowable deductions and exemptions from total income.

- Gross Income: Includes wages, business income, rental income, and investment earnings.

- Deductions and Credits: Taxpayers may claim deductions for medical expenses, educational costs, or charitable donations.

2. Taxable Property Valuation

For property taxes, assessment involves evaluating the current market value of the property.

- Assessment Ratios: The assessed value is often a percentage of the market value.

- Appraisals: Professional appraisals play a role in ensuring accurate valuations.

3. Tax Rates Application

Tax rates are applied to the taxable income or assessed property value. These rates vary depending on jurisdiction, income bracket, or property classification.

4. Assessment Notice

Once calculated, taxpayers receive an assessment notice detailing their tax liability and payment deadlines.

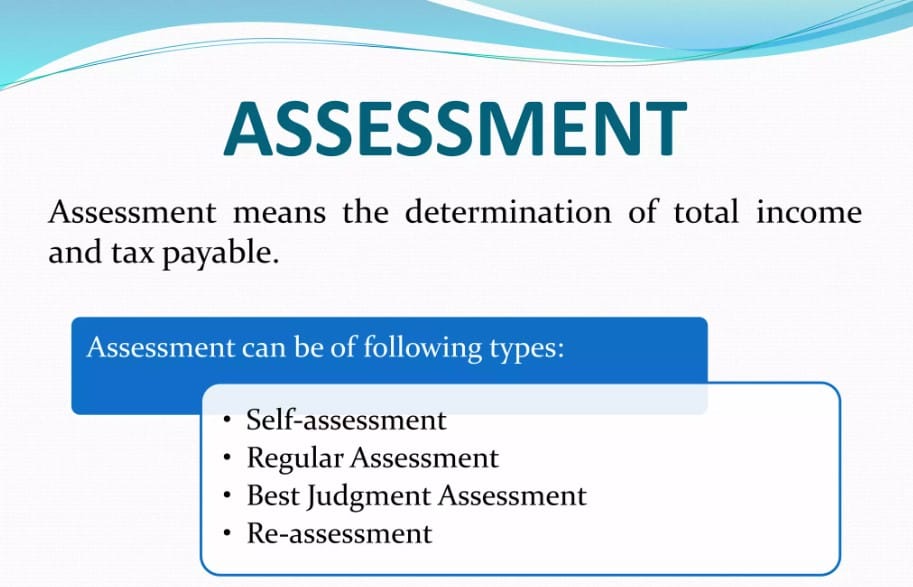

Types of Tax Assessments

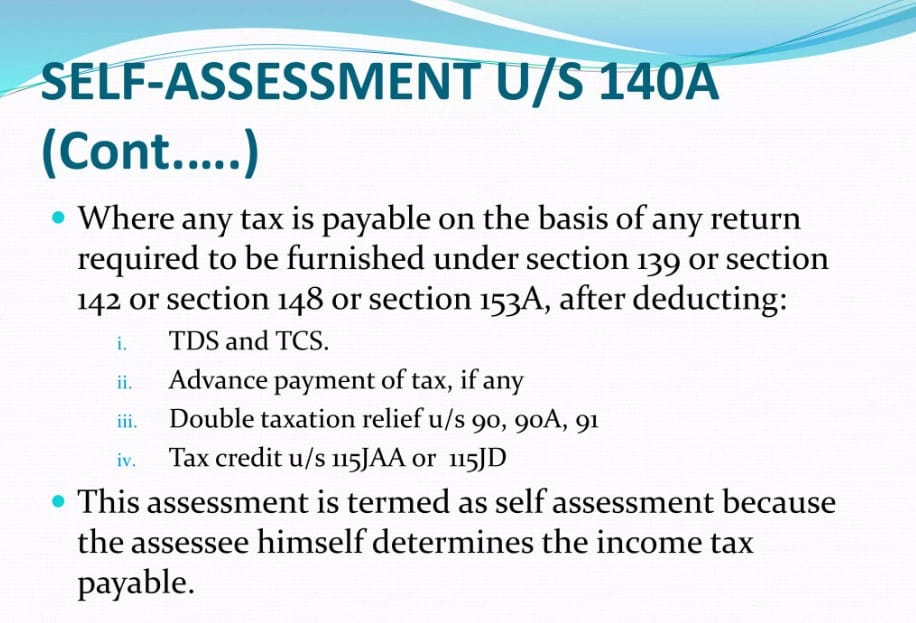

1. Self-Assessment

Under self-assessment systems, taxpayers calculate their own tax liabilities and report them to authorities.

- Benefits: Encourages transparency and reduces administrative burdens.

- Examples: Filing annual income tax returns.

2. Government-Assessed Taxes

In some cases, tax authorities perform the calculations and issue notices directly to taxpayers.

- Example: Property tax assessments based on local government appraisals.

3. Additional Assessments

These occur when discrepancies are found during audits or reviews, leading to adjusted tax liabilities.

- Example: A business underreporting its income may face an additional assessment.

Tax Assessment: Legal and Regulatory Framework

Tax assessments are governed by a combination of local, national, and international laws. Regulations vary by country but typically share common features.

Key Principles

- Fairness: Tax assessments must be equitable and transparent.

- Legal Compliance: Tax laws dictate the assessment process and any allowable deductions.

- Timeliness: Assessments must occur within specific timeframes to avoid disputes.

Regulatory Bodies

- IRS (United States): Oversees income and corporate tax assessments.

- HMRC (United Kingdom): Manages tax assessments for individuals and businesses.

- Local Authorities: Handle property tax assessments.

Examples of Tax Assessment

Income Tax Assessment

A freelance designer earning $70,000 annually calculates taxable income as follows:

- Gross Income: $70,000

- Deductions (charitable donations, medical expenses): $10,000

- Taxable Income: $60,000

Tax is then assessed based on applicable rates.

Property Tax Assessment

A homeowner owns a property valued at $300,000. If the assessment ratio is 80% and the tax rate is 2%, the property tax liability is:

- Assessed Value: $300,000 × 80% = $240,000

- Tax: $240,000 × 2% = $4,800

Corporate Tax Assessment

A company with $1,000,000 in profits claims $200,000 in deductions, leading to taxable income of $800,000. Tax is assessed based on corporate tax rates.

How to Prepare for a Tax Assessment

1. Maintain Accurate Records

Keeping detailed records of income, expenses, and deductions ensures accurate calculations.

2. Understand Tax Obligations

Familiarize yourself with the types of taxes applicable to you or your business.

3. Consult Tax Professionals

Tax advisors can help navigate complex assessments and identify potential savings.

4. Use Tax Software

Modern tax software simplifies calculations and reduces errors.

5. Respond to Assessment Notices

Always review and address assessment notices promptly to avoid penalties or disputes.

Common Challenges in Tax Assessments

1. Disputes Over Valuations

Property owners often contest assessed values, especially during market fluctuations.

2. Errors in Reporting

Mistakes in income reporting or deduction claims can lead to incorrect assessments.

3. Non-Compliance Penalties

Failure to comply with tax laws results in fines, interest, or legal actions.

Appealing a Tax Assessment

Taxpayers have the right to appeal assessments if they believe errors occurred.

Steps in the Appeal Process

- Review Assessment Details: Understand the basis of the assessment.

- Submit Supporting Documentation: Provide evidence for your claim.

- Engage Legal Representation: Tax attorneys can assist with complex cases.

- File Within Deadlines: Appeals must be submitted within prescribed timeframes.

Outcome of Appeals

Successful appeals may result in reduced liabilities or revised valuations.

FAQs

What is a tax assessment?

A tax assessment calculates the taxable income or asset value to determine the tax owed by an individual or business.

Who conducts property tax assessments?

Local government authorities or designated assessors handle property tax assessments.

Can tax assessments be disputed?

Yes, taxpayers can appeal assessments if they believe they are inaccurate or unfair.

What happens if I ignore an assessment notice?

Ignoring assessment notices can lead to penalties, interest, or legal actions from tax authorities.

Are self-assessments mandatory?

In many countries, self-assessment is required for filing annual income taxes.

How can I lower my tax liability?

You can reduce liability by claiming allowable deductions, credits, and exemptions.

Conclusion

Tax assessments are a cornerstone of fiscal responsibility, ensuring fairness and transparency in the taxation system. By understanding how assessments work and preparing diligently, taxpayers can meet their obligations while minimizing potential liabilities. Whether you're an individual, a property owner, or a business, staying informed and proactive about tax assessments will save time, money, and unnecessary stress.