How to Build Credit Without a Credit Card (Proven, Safe & Fast)

If you’ve ever been told, “You need credit to build credit,” you know how frustrating it feels.

Millions of people—students, freelancers, immigrants, and debt-averse savers—want a strong credit score without using a credit card. The good news? You can absolutely build credit without a credit card, and you can do it safely, ethically, and faster than most people think.

In this in-depth, data-backed guide, you’ll learn exactly how to build credit without a credit card, using methods recognized by credit bureaus, lenders, and scoring models. I’ll break down what really works, what to avoid, and how to create a long-term credit profile that opens doors to loans, rentals, and better interest rates—without swiping a single card.

1️⃣ Why Credit Matters (Even If You Hate Debt)

Your credit score isn’t just about borrowing money. It influences:

- Apartment approvals

- Security deposits for utilities

- Insurance premiums

- Job background checks (in some regions)

- Business financing

According to the Consumer Financial Protection Bureau, over 45 million Americans are “credit invisible” or unscorable. That invisibility costs real money over time.

The goal here is not debt—it’s trustworthiness.

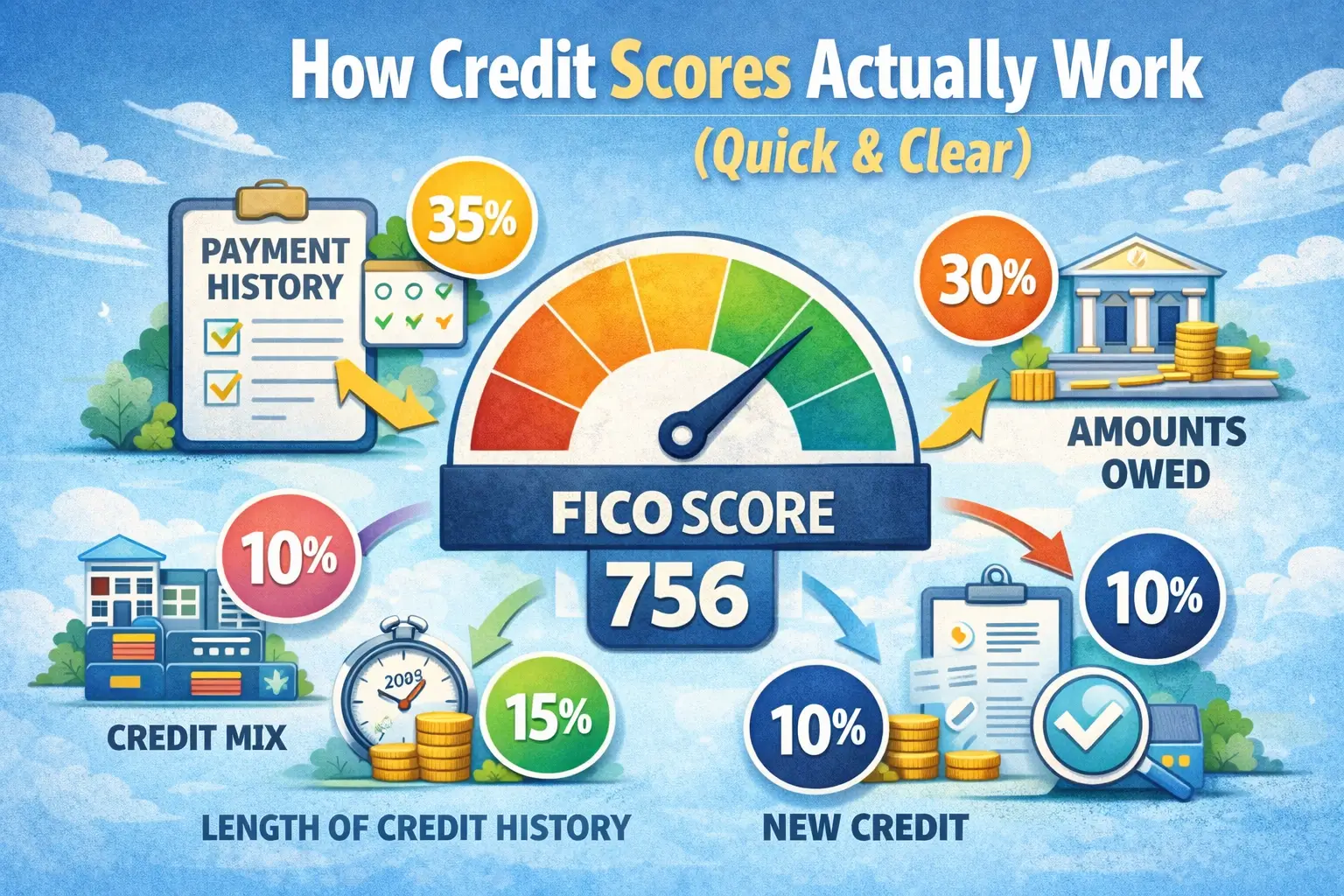

2️⃣ How Credit Scores Actually Work (Quick & Clear)

Most lenders use the FICO Score, which is calculated from five core factors:

| Factor | Weight |

|---|---|

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| Credit Mix | 10% |

| New Credit | 10% |

Notice something important:

👉 You don’t need a credit card to satisfy most of these.

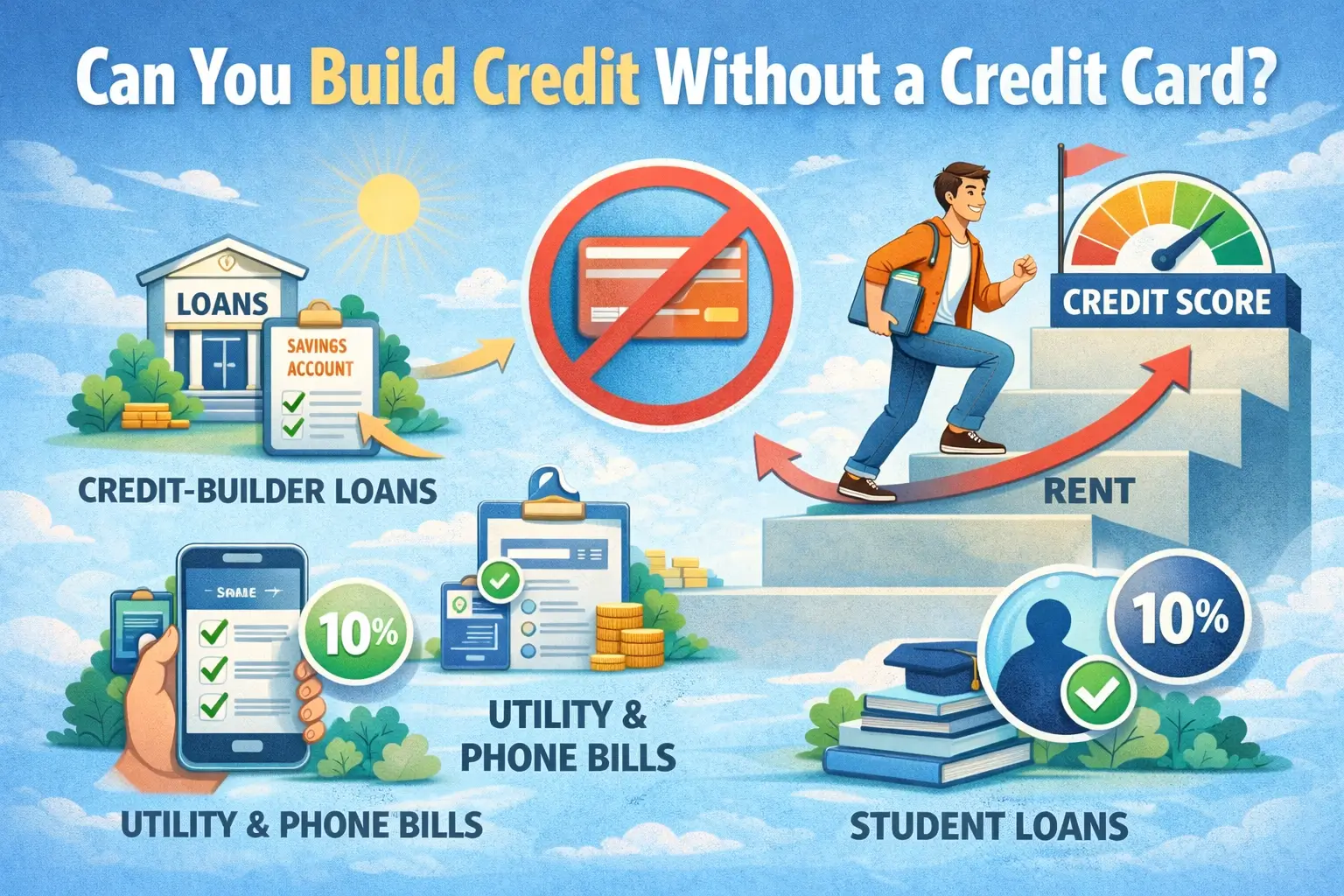

3️⃣ Can You Build Credit Without a Credit Card?

Yes—100%.

Credit cards are one tool, not the only tool.

Credit bureaus track any account that reports regularly and demonstrates on-time payments. That includes:

- Installment loans

- Rent payments

- Student loans

- Credit-builder products

- Authorized user accounts

The key is consistent reporting to Experian, Equifax, and TransUnion.

4️⃣ Credit-Builder Loans: The #1 Card-Free Strategy

What Is a Credit-Builder Loan?

A credit-builder loan is a small installment loan (usually $300–$1,500) where:

- The lender holds the money in a savings account

- You make monthly payments (usually 6–24 months)

- Payments are reported to credit bureaus

- You get the money after the loan ends

Why It Works So Well

- Builds payment history (35% of your score)

- Adds installment credit to your profile

- No risk of overspending

- Often no credit check required

Where to Find Them

- Credit unions

- Community banks

- Fintech platforms like Self or local co-ops

📊 Data Point:

A 2023 Experian study found that consumers using credit-builder loans saw an average score increase of 20–60 points within 6–12 months.

5️⃣ Rent Reporting: Turn Monthly Rent Into Credit History

If you pay rent every month, you’re already proving financial reliability—you just need it reported.

How Rent Reporting Works

Rent reporting services verify your rent payments and send them to credit bureaus.

Popular Options

- Experian RentBureau

- RentTrack

- PayYourRent

- ClearNow

Pros & Cons

Pros

- No debt required

- Huge monthly payment history boost

- Perfect for renters

Cons

- Some services charge $5–$15/month

- Not all landlords participate

🔍 Pro Tip:

Even if only one bureau receives rent data, it still helps lenders see consistency.

6️⃣ Utility & Phone Bills: What Counts (and What Doesn’t)

Most utilities do not report positive payments by default. However:

What Can Help

- Phone bills via alternative credit data programs

- Utilities reported through Experian Boost

What Hurts

- Late or collections accounts

- Unpaid bills sent to collections agencies

Bottom line:

Utilities help indirectly, but they shouldn’t be your primary strategy.

7️⃣ Authorized User (Without Owning a Card)

You can build credit without owning a credit card by becoming an authorized user on someone else’s account.

How It Helps

- You inherit the account’s age and payment history

- No responsibility to spend or manage the card

- No hard inquiry

Rules for Success

- Account must have perfect payment history

- Low utilization (under 30%)

- Long-standing account (2+ years)

⚠️ Warning:

If the primary user misses a payment, your credit suffers too.

8️⃣ Buy Now, Pay Later (BNPL): Helpful or Risky?

BNPL services like Klarna or Affirm are popular—but not all help credit.

When BNPL Helps

- Reports to credit bureaus

- Structured installment payments

- On-time payment history

When BNPL Hurts

- Missed payments

- Overuse across multiple platforms

- Accounts sent to collections

🧠 Use BNPL sparingly, not as a main credit strategy.

9️⃣ Student Loans & Installment Accounts

Federal and private student loans do build credit, even while deferred.

- On-time payments help

- Long account age strengthens history

- Missed payments cause serious damage

If you already have student loans, you’re building credit automatically—just protect it.

🔟 Credit Mix: Why Installment Loans Matter

Lenders like to see different account types:

- Installment loans (credit-builder, student loans)

- Revolving credit (cards—but optional)

Since we’re avoiding cards, installment loans become essential.

1️⃣1️⃣ How Long It Takes to Build Credit Without Cards

| Timeframe | What Happens |

|---|---|

| 30 days | First account appears |

| 3 months | Score becomes scorable |

| 6 months | Meaningful improvement |

| 12 months | Strong starter credit |

Consistency beats speed—always.

1️⃣2️⃣ Common Myths & Costly Mistakes

❌ Myth: “You must have a credit card”

❌ Myth: “Checking credit hurts your score”

❌ Myth: “Carrying debt improves credit”

🚫 Real Mistakes to Avoid:

- Missing one payment

- Opening too many accounts at once

- Ignoring credit reports

1️⃣3️⃣ A Simple 90-Day Credit-Building Plan (No Card)

Month 1

- Open a credit-builder loan

- Enroll in rent reporting

- Check credit reports

Month 2

- Make all payments early

- Avoid new inquiries

- Monitor score changes

Month 3

- Add authorized user (optional)

- Keep utilization low

- Stay consistent

1️⃣4️⃣ Tools to Monitor Credit for Free

- Experian Free Account

- Credit Karma

- AnnualCreditReport.com (official, .gov)

Monitoring helps you catch errors early—a huge trust signal for lenders.

✅ Final Takeaways: Build Credit Without a Credit Card—For Real

You don’t need plastic to prove responsibility.

You need consistency, reporting, and patience.

Best strategies to remember:

- Credit-builder loans work fastest

- Rent reporting is a hidden gem

- Installment history beats revolving debt

- One missed payment can undo months of progress

🎯 Your next step:

Start with one method today. Credit rewards momentum.

FAQs

1. Can you build credit without a credit card at all?

Yes. Installment loans, rent reporting, student loans, and authorized user accounts can all build credit without owning a credit card.

2. What is the fastest way to build credit without a credit card?

Credit-builder loans combined with rent reporting typically deliver the fastest, safest results.

3. Does paying rent build credit automatically?

No. Rent only builds credit if it’s reported through a rent-reporting service or participating landlord.

4. How long does it take to get a credit score without a card?

Usually 3–6 months of reported activity are required to generate a score.

5. Is it better to avoid credit cards completely?

For some people, yes. If cards encourage overspending, card-free credit building is often safer and more sustainable.