Can You Have a Robo Roth IRA? Simplifying Investing Through Automation

Saving for retirement is no small task. With an endless array of financial tools available, figuring out the best way to secure your golden years can feel overwhelming. This is where the combination of a Roth IRA—a tax-advantaged retirement account—and robo-advisors comes into play. Can you have a Robo Roth IRA? Absolutely! And it's not just possible; it’s also one of the most efficient ways to automate your investments while sticking to a long-term strategy.

This article will dive into the ins and outs of using robo-advisors to manage a Roth IRA, covering everything from the basics to their benefits, drawbacks, and top providers.

What Is a Robo Roth IRA?

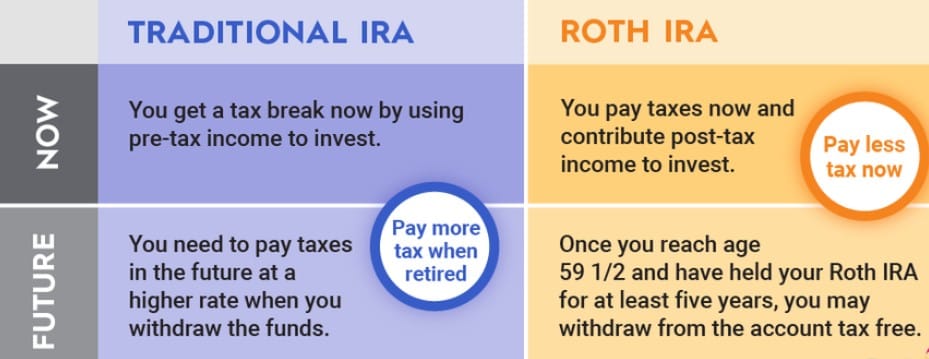

A Robo Roth IRA is simply a Roth IRA account managed by a robo-advisor. A Roth IRA is a retirement savings account that allows post-tax contributions, which means your money grows tax-free and can be withdrawn tax-free in retirement. Meanwhile, robo-advisors are automated platforms that manage your investments using algorithms.

When these two concepts combine, you get a highly efficient, low-cost, and hands-off retirement savings tool. Robo-advisors manage your Roth IRA by automating asset allocation, rebalancing your portfolio, and maximizing returns—all with minimal human intervention.

How Does a Robo Roth IRA Work?

A Robo Roth IRA follows a straightforward process:

- Account Setup: You create a Roth IRA through a robo-advisor platform, input your financial goals, risk tolerance, and retirement timeline.

- Portfolio Allocation: The robo-advisor builds a diversified investment portfolio tailored to your goals. Most portfolios include a mix of ETFs (Exchange-Traded Funds) representing stocks, bonds, and other asset classes.

- Automated Contributions: You can schedule recurring contributions to your account, ensuring you’re consistently investing.

- Rebalancing: The robo-advisor periodically adjusts your portfolio to maintain your desired asset allocation as the market fluctuates.

- Tax Optimization: Some robo-advisors include features like tax-loss harvesting, though this is more relevant for taxable accounts than Roth IRAs.

The Benefits of a Robo Roth IRA

1. Automation and Simplicity

Robo-advisors eliminate the complexity of managing a Roth IRA. Once you set your preferences, the algorithm takes care of the rest, including investing your contributions, maintaining diversification, and rebalancing your portfolio.

2. Low Fees

Traditional financial advisors typically charge fees of 1% or more of your portfolio's value annually. Robo-advisors, on the other hand, charge significantly lower fees—often ranging from 0.25% to 0.50%—making them an affordable choice for small and mid-sized investors.

3. Accessibility

Robo-advisors allow you to open a Roth IRA with low minimum balances. Some platforms, like SoFi or Betterment, let you start investing with as little as $1.

4. Customization

Despite being automated, robo-advisors offer customization options to align your portfolio with your financial goals, risk tolerance, and time horizon.

5. Long-Term Focus

By automating contributions and maintaining a consistent investment strategy, a Robo Roth IRA encourages disciplined, long-term savings habits—an essential component of retirement planning.

Drawbacks to Consider

While a Robo Roth IRA is an excellent option for many investors, it’s not without its downsides:

1. Lack of Human Interaction

Robo-advisors rely entirely on algorithms, so there’s no human advisor to consult for personalized advice or emotional reassurance during market volatility.

2. Limited Tax Strategies

Although Roth IRAs are tax-advantaged, robo-advisors typically don’t offer comprehensive tax-planning strategies beyond basic optimizations like rebalancing.

3. Standardized Portfolios

The portfolios created by robo-advisors are generally one-size-fits-all based on your inputs. If you have highly specific investment needs or want to include niche investments, a robo-advisor may not be the best fit.

4. Dependence on Technology

Robo-advisors are dependent on algorithms and technology, meaning glitches or platform issues could potentially disrupt account management.

Top Robo-Advisors for Roth IRAs

1. Betterment

Betterment is one of the most popular robo-advisors and is ideal for beginners. It offers:

- Low fees (0.25%-0.40%)

- No account minimum

- Goal-based investing tools

- Tax-efficient investing

2. Wealthfront

Wealthfront is another top-tier option, offering:

- A minimum investment of $500

- Advanced financial planning tools

- Tax-loss harvesting

- High-quality ETFs

3. Vanguard Digital Advisor

Known for its reputation, Vanguard’s robo-advisor provides:

- A trusted platform with low-cost index funds

- A $3,000 minimum balance

- Low fees (0.15%-0.20%)

4. SoFi Automated Investing

For those seeking an ultra-low-cost option, SoFi offers:

- No management fees

- Free financial advice

- Zero account minimum

5. M1 Finance

M1 Finance is a hybrid platform combining automation with customization, featuring:

- A flexible pie-based portfolio design

- No fees for basic accounts

- A $100 minimum balance

How to Choose the Right Robo Roth IRA

Evaluate Your Needs

- Do you need a low-cost platform?

- Are financial planning tools important to you?

- Do you prefer a platform with a high level of customization?

Consider Fees

Although robo-advisors are generally affordable, even small differences in fees can impact your portfolio’s long-term growth.

Check for Features

Look for features like tax-efficient investing, financial planning tools, and goal-setting capabilities to match your needs.

Can You Max Out a Robo Roth IRA?

Yes, you can max out a Robo Roth IRA, just as you would with a traditional Roth IRA. For 2024, the contribution limit is $6,500 for individuals under 50 and $7,500 for those aged 50 and older. Setting up automatic contributions through your robo-advisor ensures you stay on track to hit these limits.

Who Should Use a Robo Roth IRA?

A Robo Roth IRA is suitable for:

- Beginners: Those new to investing who want a hands-off solution.

- Busy Professionals: People with limited time to manage their portfolios.

- Cost-Conscious Investors: Those who want to minimize fees without sacrificing quality.

- Long-Term Investors: Anyone focusing on building retirement savings over decades.

How Does a Robo Roth IRA Compare to Traditional Investment Methods?

Cost

Traditional advisors are significantly more expensive than robo-advisors.

Convenience

Robo-advisors offer unmatched convenience with automated processes, while traditional methods require more active management.

Customization

Although traditional advisors can tailor portfolios more precisely, robo-advisors now offer enough customization to satisfy most investors.

FAQs

What is a Robo Roth IRA?

A Robo Roth IRA is a Roth IRA account managed by a robo-advisor, automating your investment strategy to save for retirement efficiently.

Are Robo Roth IRAs safe?

Yes, they are as safe as traditional Roth IRAs. Your investments are held by custodians and protected by regulations, but market risks still apply.

How much do I need to start a Robo Roth IRA?

Many robo-advisors allow you to start with as little as $0-$500, making it accessible for all investors.

Can I choose specific investments in a Robo Roth IRA?

Most robo-advisors build standardized portfolios, but some, like M1 Finance, allow more customization.

Do robo-advisors offer financial advice?

While robo-advisors provide automated financial tools, many also offer access to human advisors for additional guidance.

Can I switch from a traditional Roth IRA to a Robo Roth IRA?

Yes, you can roll over your traditional Roth IRA to a robo-advisor platform. Ensure you follow IRS rollover guidelines to avoid penalties.

Conclusion

Can you have a Robo Roth IRA? Absolutely, and it’s one of the smartest ways to automate your retirement savings. With low fees, simplicity, and advanced features, robo-advisors make it easy for anyone to build wealth for the future. Whether you’re new to investing or simply looking for a hands-off approach, a Robo Roth IRA might be the perfect solution to help you achieve your retirement goals.