Difference Between 401(k) and 403(b) Accounts: A Complete Guide

Saving for retirement is a top priority for many individuals, but navigating the sea of retirement plans can feel overwhelming. Two popular options in the United States are the 401(k) and 403(b) accounts. Both are designed to help people save for their golden years, but they have distinct features, eligibility requirements, and benefits.

This article dives deep into the difference between 401(k) and 403(b) accounts, equipping you with all the information you need to make an informed decision about which plan is right for you.

What Are 401(k) and 403(b) Accounts?

Overview of 401(k) Plans

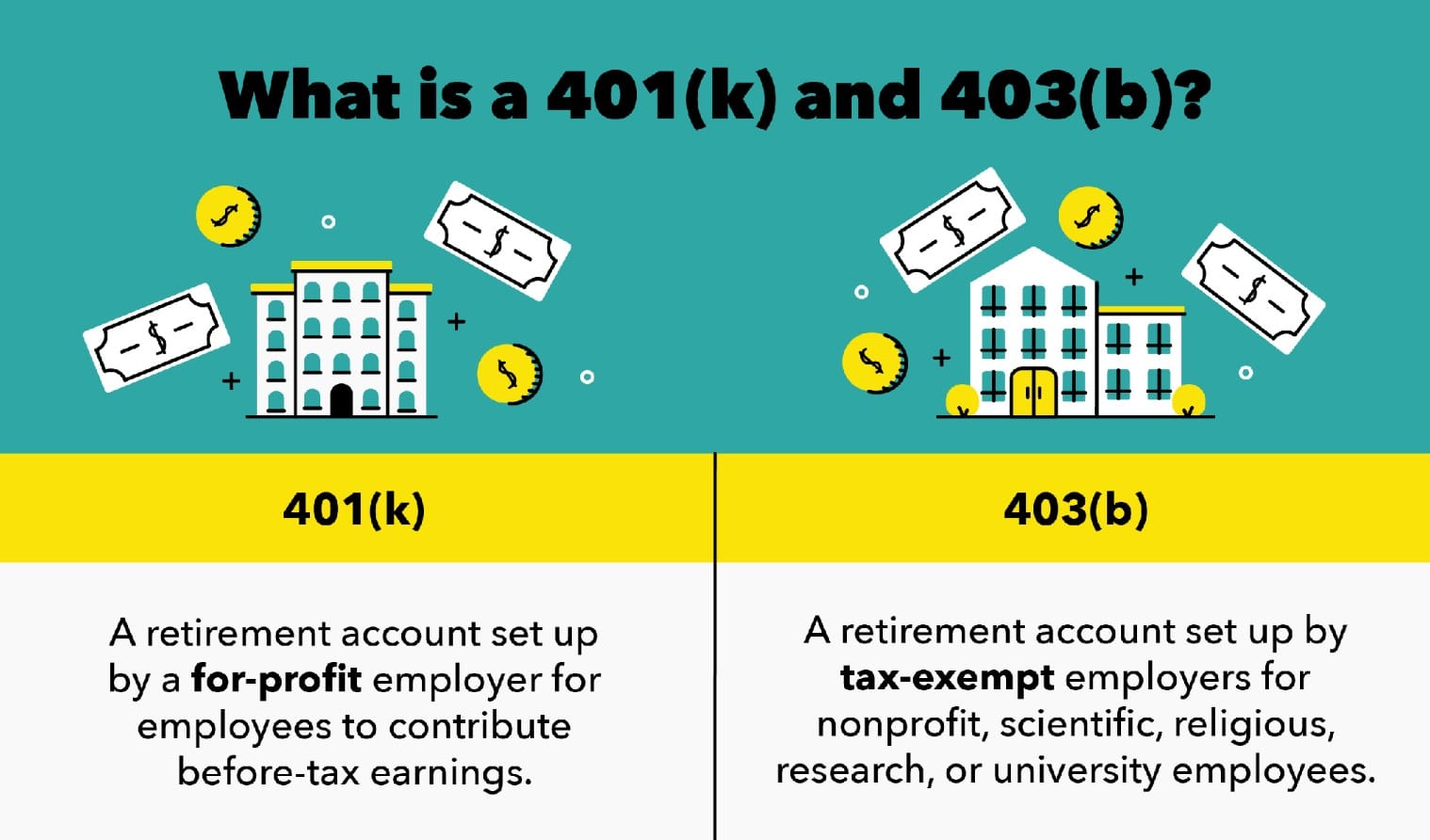

A 401(k) plan is a tax-advantaged retirement savings account primarily offered by private-sector employers. Named after the section of the Internal Revenue Code that created it, the 401(k) allows employees to contribute a portion of their salary to an investment account, often with employer matching contributions.

Overview of 403(b) Plans

The 403(b) plan, also known as a tax-sheltered annuity (TSA) plan, is another tax-advantaged retirement savings vehicle. However, it is specifically designed for employees of nonprofit organizations, public schools, and certain tax-exempt institutions.

Key Similarities Between the Two

- Both are tax-deferred accounts, meaning contributions are made pre-tax, and taxes are paid upon withdrawal.

- They both offer Roth options, where contributions are made post-tax but withdrawals in retirement are tax-free.

- Contribution limits are similar for both plans.

Eligibility: Who Can Open a 401(k) or 403(b) Account?

Eligibility for a 401(k)

A 401(k) plan is typically offered by private-sector employers. To participate:

- You must be an employee of a company that offers the plan.

- Some employers have a waiting period (e.g., 3 to 12 months of employment) before new hires can enroll.

Eligibility for a 403(b)

403(b) plans are reserved for employees of:

- Public schools and colleges.

- Churches or religious organizations.

- Nonprofit organizations classified under Section 501(c)(3) of the Internal Revenue Code.

Contribution Limits for 401(k) and 403(b) Accounts

Annual Contribution Limits

The IRS sets contribution limits for both plans, which are updated annually to adjust for inflation:

- In 2025, the limit is $22,500 for individuals under 50.

- Those aged 50 and older can contribute an additional $7,500 as a catch-up contribution.

Unique Contribution Rules for 403(b)

One notable difference is that 403(b) participants who have worked for a qualifying employer for at least 15 years may be eligible for an additional catch-up contribution of $3,000 per year, up to a lifetime maximum of $15,000.

Employer Contributions

Both 401(k) and 403(b) plans often include employer contributions. However:

- Private companies offering 401(k) plans often match a percentage of the employee's contribution.

- Nonprofits with 403(b) plans may have limited resources, leading to less frequent or smaller matching contributions.

Investment Options: What Can You Invest In?

Investment Choices in a 401(k)

- Mutual funds, index funds, and target-date funds are common options.

- Some plans also offer stocks, bonds, and other securities.

Investment Choices in a 403(b)

- Historically, 403(b) plans were limited to annuity products, but modern plans now include mutual funds and other low-cost investment options.

- However, 403(b) plans generally have fewer investment choices compared to 401(k) plans.

Fees and Expenses: 401(k) vs. 403(b)

401(k) Fees

- Plan administration fees, investment management fees, and individual service fees are common.

- Employers may negotiate lower fees, but costs can still be significant.

403(b) Fees

- Historically, 403(b) plans were known for higher fees, particularly with annuities.

- Recent regulatory changes have encouraged more transparency and lower-cost options, such as mutual funds.

Key Difference

403(b) plans often come with higher fees due to limited investment choices and historical reliance on annuities.

Tax Benefits: How Do They Compare?

Tax Benefits of a 401(k)

- Contributions are made pre-tax, reducing taxable income in the year of contribution.

- Earnings grow tax-deferred until withdrawal, at which point they are taxed as ordinary income.

Tax Benefits of a 403(b)

The tax treatment for 403(b) accounts is nearly identical to that of 401(k) accounts. However, the additional catch-up contribution for long-term employees of nonprofits can provide unique tax advantages.

Withdrawal Rules: Accessing Your Money

401(k) Withdrawal Rules

- Early withdrawals before age 59½ incur a 10% penalty, plus income tax.

- Required Minimum Distributions (RMDs) must begin at age 73.

403(b) Withdrawal Rules

- Similar rules apply, but clergy members may receive certain tax-free housing allowances from their 403(b) distributions.

Loans and Hardship Withdrawals

Both plans allow loans and hardship withdrawals, but the rules and availability depend on the employer.

Advantages of 401(k) Plans

- Often include robust employer matching contributions.

- More investment options compared to 403(b) plans.

- Lower fees in many cases.

Advantages of 403(b) Plans

- Additional catch-up contributions for long-term employees.

- Specifically designed for nonprofit and public sector workers.

- Clergy members may benefit from unique withdrawal tax exemptions.

How to Choose Between a 401(k) and 403(b)

Evaluate Your Employer

- If you work for a private company, a 401(k) will be your only option.

- Nonprofit and public-sector employees are generally limited to 403(b) plans.

Consider Your Career Goals

- If you anticipate switching between private and nonprofit sectors, you may need to roll over your account between plans.

Compare Employer Contributions

Employer contributions can significantly boost your retirement savings, so prioritize plans with generous matching policies.

Frequently Asked Questions

What is the main difference between 401(k) and 403(b) accounts?

401(k) accounts are offered by private-sector employers, while 403(b) accounts are available to employees of nonprofits, public schools, and certain tax-exempt organizations.

Can I have both a 401(k) and a 403(b)?

Yes, but the combined contribution limit across both accounts must not exceed the IRS annual limit.

Which plan has better investment options?

401(k) plans typically have more investment options compared to 403(b) plans.

Do 403(b) plans always have higher fees?

Not necessarily, but they are historically associated with higher fees, particularly when annuities are involved.

What happens to my account if I change jobs?

You can roll over your 401(k) or 403(b) into a new employer’s plan or an Individual Retirement Account (IRA).

Are 403(b) accounts better for nonprofit employees?

Yes, because they offer additional benefits, such as unique catch-up contributions and potential tax exemptions for clergy members.

Conclusion

Understanding the difference between 401(k) and 403(b) accounts is crucial for choosing the right retirement savings plan. While 401(k) accounts often provide more investment options and employer matching, 403(b) plans cater to the unique needs of nonprofit and public-sector employees with specialized benefits.

Evaluate your career, employer, and long-term financial goals to determine which plan suits you best. Regardless of your choice, starting early and contributing consistently are the keys to a comfortable retirement.