EMV: What It Means, How It Works, and Limitations

The payment industry has undergone a massive transformation, and EMV technology is at the center of it. Designed to reduce fraud and enhance transaction security, EMV chip cards have become the global standard for in-person payments.

Despite their widespread adoption, many still wonder: What does EMV mean? How does it work? What are its limitations?

This article dives deep into EMV technology, explaining its benefits, drawbacks, and impact on the future of digital transactions.

What is EMV?

Definition of EMV

EMV stands for Europay, Mastercard, and Visa—the three companies that developed this chip-based payment standard. It replaces the traditional magnetic stripe system, adding dynamic authentication for increased security.

Why Was EMV Developed?

Before EMV, card fraud was rampant. Magnetic stripe cards stored static data, making them easy to clone. EMV was introduced to:

- Reduce card-present fraud by making counterfeit cards nearly impossible to create.

- Improve global payment security with a unified standard.

- Enhance transaction verification through PINs, signatures, or contactless methods.

How EMV Works

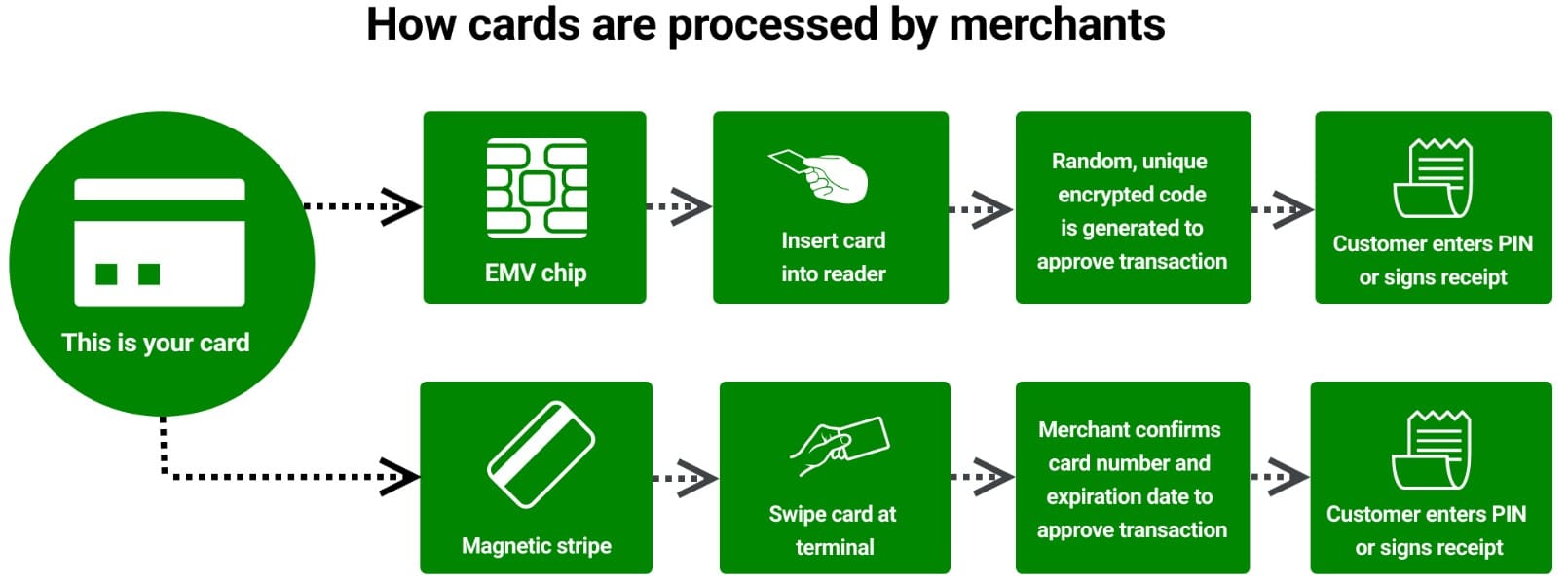

The EMV Transaction Process

1. Card Insertion (Dipping) or Tapping

- Instead of swiping, the EMV chip card is either inserted into a terminal or used contactlessly via NFC (Near Field Communication).

- The terminal reads the chip and initiates a secure transaction.

2. Dynamic Authentication

- Unlike magnetic stripes, which use static data, EMV chips generate a unique cryptographic code for every transaction.

- If fraudsters steal this code, they cannot reuse it.

3. User Authentication

- Transactions require verification through:

- PIN Entry (Chip-and-PIN)

- Signature Matching (Chip-and-Signature)

- Biometric Authentication (in future versions)

4. Transaction Authorization

- The terminal communicates with the bank or card network to approve or decline the transaction.

Types of EMV Cards

Chip-and-PIN Cards

- Require users to enter a 4 to 6-digit PIN for authentication.

- Used widely in Europe, Asia, and parts of Africa.

Chip-and-Signature Cards

- Require a signature instead of a PIN for verification.

- Common in the United States but less secure than Chip-and-PIN.

Dual-Interface EMV Cards

- Support both contact and contactless transactions.

- Offer the flexibility of dipping or tapping for payments.

Benefits of EMV Technology

1. Stronger Fraud Prevention

✅ Dynamic authentication makes it nearly impossible to clone an EMV chip card.

✅ Reduces card-present fraud significantly.

2. Global Acceptance

✅ EMV is the standard in over 80% of countries, ensuring seamless international transactions.

3. Liability Shift Protection

✅ Merchants without EMV-capable terminals assume liability for fraudulent transactions.

4. Contactless Payments for Faster Transactions

✅ EMV cards support tap-and-go technology, making checkouts faster.

✅ Reduces wear-and-tear on cards.

5. Integration with Digital Wallets

✅ Works with Apple Pay, Google Pay, Samsung Pay, and other mobile wallets.

Limitations of EMV Technology

1. High Implementation Costs

❌ Businesses must upgrade to EMV-compliant terminals, which can be expensive.

2. Slower Transaction Speed

❌ EMV transactions take a few seconds longer than magnetic stripe swipes.

3. Does Not Prevent Online Fraud

❌ EMV protects only card-present transactions.

❌ E-commerce fraud still requires additional security measures like 3D Secure and tokenization.

4. PIN Theft Risks

❌ Skimming devices and hidden cameras can still steal PINs during entry.

5. Compatibility Issues with Older Systems

❌ Some legacy payment systems do not support EMV, leading to transaction failures.

EMV vs. Other Payment Technologies

| Feature | EMV Chip Cards | Magnetic Stripe Cards | Contactless Payments |

|---|---|---|---|

| Security | High | Low | Medium to High |

| Fraud Prevention | Strong | Weak | Moderate |

| Transaction Speed | Medium | Fast | Fastest |

| Global Acceptance | High | Limited | Growing |

| Usability for Online Transactions | Limited | Limited | Strong |

The Future of EMV Technology

1. Biometric EMV Cards

🔹 Future EMV cards may include fingerprint or facial recognition for extra security.

2. AI-Based Fraud Detection

🔹 Banks and merchants are leveraging artificial intelligence (AI) to detect suspicious transactions in real time.

3. Blockchain and EMV Integration

🔹 Blockchain could eliminate intermediaries, reducing transaction costs and increasing security.

4. Advanced Tokenization for E-commerce

🔹 Tokenization replaces card numbers with unique tokens, improving online security.

Frequently Asked Questions

What does EMV stand for?

EMV stands for Europay, Mastercard, and Visa, the companies that created the chip-based payment standard.

How does EMV improve security?

EMV technology uses dynamic authentication, meaning each transaction generates a unique code that cannot be reused.

Are businesses required to accept EMV cards?

No, but businesses that don’t upgrade to EMV terminals assume liability for fraudulent transactions.

Is contactless EMV as secure as chip insertion?

Yes, contactless EMV uses NFC encryption and tokenization, making it secure.

Why are EMV transactions slower than magnetic stripe swipes?

The chip verification process takes a few extra seconds, but contactless payments reduce this delay.

Can EMV prevent online fraud?

No, EMV is designed for in-store transactions. Online fraud prevention relies on tokenization and multi-factor authentication.

Conclusion

EMV technology has revolutionized payment security, significantly reducing card-present fraud and introducing safer transaction methods worldwide. However, it’s not without its challenges—higher costs, slower speeds, and vulnerability to online fraud still exist.

As payment systems continue evolving, innovations like biometric EMV cards, AI fraud detection, and blockchain integration promise even greater security. Whether you’re a business owner, consumer, or financial expert, staying informed about EMV and future payment technologies is crucial.