Personal Loans vs. Credit Cards: What’s the Difference?

When it comes to managing personal finances, choosing between a personal loan and a credit card can be a crucial decision. Both are popular forms of borrowing, each offering unique benefits and drawbacks. However, understanding the key differences between personal loans and credit cards can help you make an informed decision that aligns with your financial goals and circumstances.

Let's delve into the details, comparing and contrasting these two financial tools, so you can decide which option suits you best.

Understanding Personal Loans

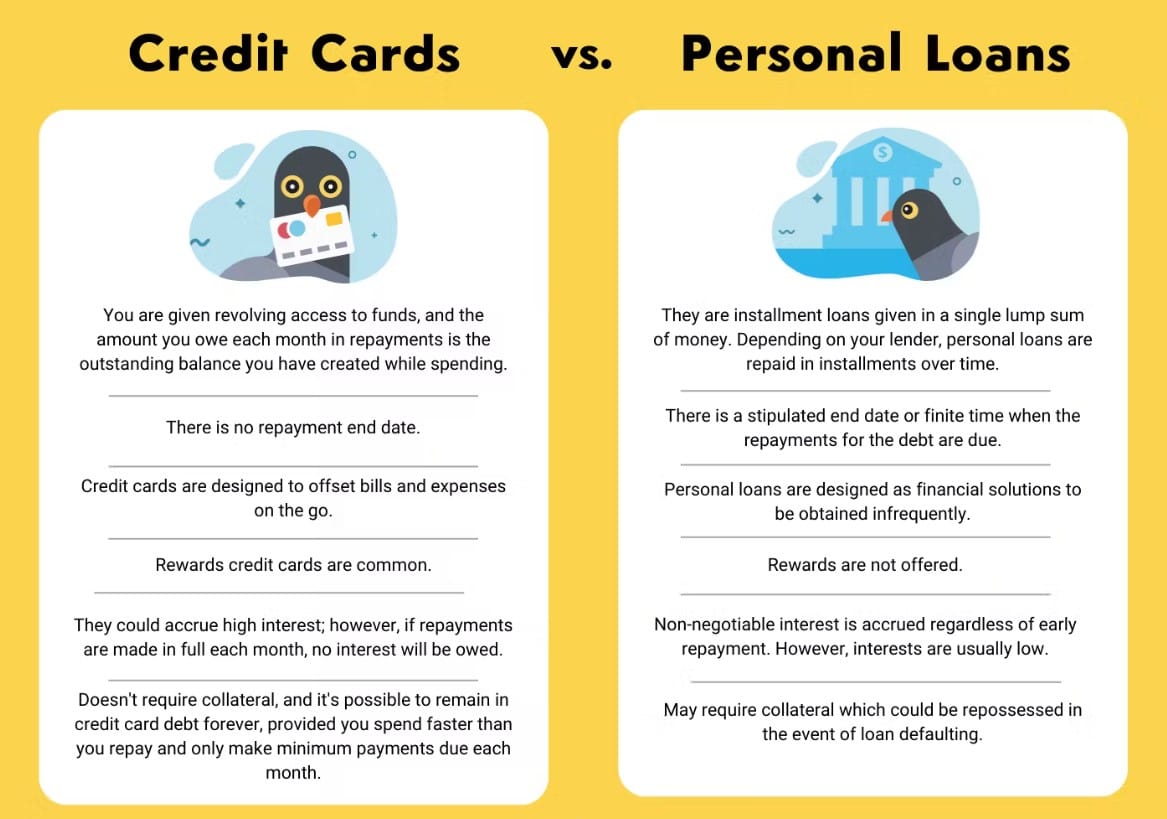

A personal loan is a lump sum of money borrowed from a bank, credit union, or online lender, which is repaid in fixed monthly installments over a set period, typically ranging from two to seven years. Personal loans are often unsecured, meaning they don't require collateral, although secured loans are available if you have assets to pledge.

Personal loans can be used for various purposes, such as consolidating debt, financing a large purchase, or covering unexpected expenses. The interest rates on personal loans are generally fixed, providing borrowers with predictable monthly payments. However, the interest rates can vary widely depending on your credit score, income, and the lender's policies.

Advantages of Personal Loans

- Fixed Interest Rates and Payments: One of the most significant advantages of personal loans is the stability they offer. With a fixed interest rate, you know exactly how much you'll pay each month, which can make budgeting easier. This predictability is appealing to those who prefer a structured repayment plan.

- Lump Sum Disbursement: When you take out a personal loan, you receive the entire loan amount upfront. This feature makes personal loans ideal for large, one-time expenses, such as home renovations or medical bills.

- Lower Interest Rates: Personal loans typically have lower interest rates compared to credit cards, especially if you have good credit. This lower cost of borrowing can make personal loans a more affordable option for financing significant expenses.

- No Collateral Required: Most personal loans are unsecured, meaning you don't need to put up any assets as collateral. This lack of collateral reduces the risk to the borrower, although it may result in higher interest rates if you have a lower credit score.

Disadvantages of Personal Loans

- Strict Repayment Terms: While fixed payments can be an advantage, they can also be a drawback if your financial situation changes. If you lose your job or face unexpected expenses, it can be challenging to keep up with the fixed monthly payments.

- Origination Fees: Many personal loans come with origination fees, which can range from 1% to 8% of the loan amount. These fees are typically deducted from the loan proceeds, reducing the amount of money you receive.

- Potential Impact on Credit Score: Applying for a personal loan can temporarily lower your credit score due to the hard inquiry made by the lender. Additionally, if you struggle to make payments, your credit score could suffer further.

- No Credit Utilization Benefit: Personal loans do not impact your credit utilization ratio, a factor that makes up 30% of your credit score. While this might sound like a positive, it means that paying off a personal loan won’t help improve this aspect of your credit profile.

Exploring Credit Cards

Credit cards offer a revolving line of credit that allows you to borrow up to a certain limit. Unlike personal loans, credit cards are not disbursed as a lump sum; instead, they offer the flexibility to borrow as needed. You are required to make at least the minimum payment each month, but you can carry a balance if you prefer, which accrues interest.

Credit cards are commonly used for everyday purchases, travel, and emergencies. They also come with various perks, such as rewards points, cash back, and travel benefits, which can make them an attractive option for those who can manage their spending responsibly.

Advantages of Credit Cards

- Flexibility in Spending: Credit cards provide unmatched flexibility in how and when you use the credit. You can borrow only what you need and repay it on your schedule, provided you meet the minimum payment requirements.

- Rewards and Perks: Many credit cards offer rewards programs that allow you to earn points, miles, or cash back on your purchases. These rewards can be valuable if you use your card regularly and pay off your balance each month.

- Building Credit History: Responsible use of a credit card can help you build a strong credit history. By making payments on time and keeping your balance low relative to your credit limit, you can improve your credit score over time.

- Interest-Free Grace Periods: If you pay off your balance in full each month, you can avoid paying any interest on your purchases. This grace period can make credit cards a cost-effective option for short-term borrowing.

Disadvantages of Credit Cards

- High-Interest Rates: Credit cards typically come with higher interest rates than personal loans, especially if you carry a balance from month to month. These high rates can lead to significant debt if you're not careful with your spending.

- Temptation to Overspend: The convenience and ease of using a credit card can lead to overspending. It's easy to accumulate debt quickly, especially if you only make minimum payments each month.

- Impact on Credit Utilization: Credit cards directly impact your credit utilization ratio, which is the amount of credit you're using relative to your total available credit. High utilization can negatively affect your credit score, especially if you carry large balances.

- Variable Interest Rates: Unlike personal loans, which often have fixed rates, credit cards typically come with variable interest rates. This variability means your rate could increase over time, leading to higher borrowing costs.

Comparing Personal Loans and Credit Cards

When deciding between a personal loan and a credit card, it's essential to consider your financial needs, spending habits, and long-term goals. Here’s how personal loans and credit cards compare across several key factors:

Purpose of Use

Personal loans are generally better suited for large, one-time expenses, such as home improvements, medical bills, or consolidating high-interest debt. They provide a structured repayment plan with fixed payments, making them ideal for borrowers who prefer predictability.

Credit cards, on the other hand, are more appropriate for ongoing expenses or smaller purchases. They offer the flexibility to borrow as needed and can be a convenient way to manage everyday spending. Credit cards are also a good option for emergencies, travel, or earning rewards on routine purchases.

Cost of Borrowing

In terms of interest rates, personal loans usually have the upper hand, especially for borrowers with good credit. The fixed interest rates on personal loans mean you won’t be surprised by fluctuating rates, which can make budgeting easier. However, personal loans may come with origination fees, which add to the overall cost of borrowing.

Credit cards tend to have higher interest rates, particularly if you carry a balance from month to month. However, if you can pay off your balance in full each month, you can take advantage of the interest-free grace period, making credit cards a cost-effective option for short-term borrowing. Additionally, some credit cards offer 0% introductory APRs for a limited time, which can be a valuable tool for financing large purchases if you can pay off the balance before the promotional period ends.

Repayment Terms

Personal loans come with fixed repayment terms, which can be a blessing or a curse, depending on your financial situation. The fixed monthly payments make it easier to plan your budget, but they also mean you’re locked into a repayment schedule that may not offer much flexibility.

Credit cards offer more flexible repayment terms, allowing you to pay as little as the minimum payment each month. However, carrying a balance can lead to high interest charges, making it essential to manage your spending carefully. The flexibility of credit cards can be beneficial for those with variable income or those who need to manage cash flow, but it requires discipline to avoid falling into debt.

Impact on Credit Score

Both personal loans and credit cards can affect your credit score, but they do so in different ways. A personal loan can help diversify your credit mix, which accounts for 10% of your credit score. Successfully managing a personal loan by making on-time payments can positively impact your credit score, but missing payments can hurt it.

Credit cards, however, have a more direct impact on your credit utilization ratio, which is a significant factor in your credit score. Keeping your credit card balances low relative to your credit limit can boost your credit score, while high balances can drag it down. Additionally, the revolving nature of credit cards means they can be a long-term tool for building credit, provided they’re used responsibly.

Flexibility and Accessibility

When it comes to flexibility, credit cards are generally more accessible and easier to use than personal loans. Once approved for a credit card, you have a revolving line of credit at your disposal, which you can use as needed. This accessibility makes credit cards a convenient option for managing short-term cash flow issues or handling emergencies.

Personal loans, however, require a more formal application process, and you only receive a lump sum once approved. If you need additional funds after taking out a personal loan, you would have to apply for another loan, which can be time-consuming and may affect your credit score.

Rewards and Incentives

One area where credit cards clearly outperform personal loans is in the rewards and incentives they offer. Many credit cards come with rewards programs that allow you to earn points, miles, or cash back on your purchases. These rewards can add up quickly, especially if you use your card regularly and pay off your balance each month.

Personal loans, on the other hand, do not offer rewards or incentives. While the lower interest rates and fixed payments can be seen as a form of benefit, they don’t provide the same immediate perks that credit cards do. However, if you’re looking to consolidate debt or finance a large purchase without the temptation to overspend, a personal loan may still be the better choice.

Scenarios Where Personal Loans Might Be Better

- Debt Consolidation: If you have multiple high-interest credit card debts, a personal loan can be an excellent tool for consolidating those debts into one loan with a lower interest rate. This consolidation can simplify your finances and potentially save you money on interest.

- Large Purchases: For significant, one-time expenses such as a home renovation, a wedding, or medical bills, a personal loan can provide the necessary funds with a structured repayment plan. The fixed payments make it easier to budget for these expenses over time.

- Credit Score Improvement: If you're looking to diversify your credit mix and improve your credit score, taking out a personal loan and managing it responsibly can be a smart move. Just be sure to make your payments on time to avoid any negative impact on your credit score.

Scenarios Where Credit Cards Might Be Better

- Everyday Spending: Credit cards are ideal for managing everyday expenses, such as groceries, gas, and dining out. The convenience and flexibility they offer make them a practical choice for regular use.

- Emergency Fund Access: Having a credit card on hand can provide quick access to funds in case of an emergency. Whether it’s an unexpected car repair or a medical bill, a credit card can offer a financial safety net when you need it most.

- Earning Rewards: If you’re disciplined with your spending and can pay off your balance each month, credit cards offer a great opportunity to earn rewards on your purchases. Over time, these rewards can add up and provide significant value.

The Role of Interest Rates in Decision Making

Interest rates play a critical role in determining which option is best for you. Personal loans typically offer lower interest rates than credit cards, especially for borrowers with good credit. This lower rate makes personal loans more cost-effective for large purchases or debt consolidation. However, it’s essential to consider the total cost of borrowing, including any origination fees or other charges associated with the loan.

Credit cards, on the other hand, generally have higher interest rates, particularly if you carry a balance. However, if you can take advantage of an introductory 0% APR offer and pay off the balance before the promotional period ends, a credit card can be a very affordable option for short-term borrowing. Additionally, the rewards and perks offered by many credit cards can help offset some of the interest costs, provided you use the card responsibly.

How to Choose the Right Option for You

Choosing between a personal loan and a credit card ultimately comes down to your specific financial needs, goals, and discipline. Here are some factors to consider when making your decision:

- Your Financial Goals: If you’re looking to finance a large purchase or consolidate debt with a fixed repayment plan, a personal loan may be the better choice. However, if you need flexibility and want to earn rewards on everyday spending, a credit card might be more suitable.

- Your Spending Habits: Consider your spending habits and ability to manage debt. If you tend to overspend or carry balances from month to month, a personal loan’s fixed payments might help you stay on track. On the other hand, if you’re disciplined with your spending and can pay off your balance each month, a credit card could be a valuable tool.

- Interest Rates: Compare the interest rates offered by personal loans and credit cards. If you can secure a low-interest personal loan, it may be more cost-effective for large purchases. However, if you qualify for a 0% introductory APR on a credit card and can pay off the balance quickly, that might be the better option.

- Fees and Charges: Don’t forget to factor in any fees associated with the loan or credit card. Personal loans may come with origination fees, while credit cards may charge annual fees, balance transfer fees, or late payment fees. Be sure to read the fine print and understand all the costs involved.

- Impact on Credit Score: Consider how each option will affect your credit score. Personal loans can help diversify your credit mix and improve your score if managed responsibly. Credit cards, on the other hand, can help you build a strong credit history, but high balances can negatively impact your credit utilization ratio.

Personal Loans vs. Credit Cards: The Final Verdict

In the battle of personal loans vs. credit cards, there is no one-size-fits-all answer. Both options have their pros and cons, and the right choice depends on your individual financial situation, goals, and habits.

If you need a structured repayment plan for a large purchase or debt consolidation, a personal loan might be the better option. The fixed payments and lower interest rates can provide peace of mind and help you manage your finances more effectively.

However, if you need flexibility, rewards, and the ability to manage smaller, ongoing expenses, a credit card could be the better choice. Just be sure to use it responsibly and pay off your balance each month to avoid falling into debt.

Ultimately, the key to making the right decision is to thoroughly assess your needs, compare the options, and choose the financial tool that best aligns with your goals. Whether you opt for a personal loan or a credit card, responsible management is crucial to maintaining your financial health and achieving your long-term objectives.

FAQs

What are the main differences between personal loans and credit cards?

Personal loans are typically lump-sum amounts with fixed interest rates and repayment terms, making them ideal for large, one-time expenses. Credit cards offer a revolving line of credit with flexible repayment options and higher interest rates, suitable for ongoing expenses and smaller purchases.

Can I use a personal loan to pay off credit card debt?

Yes, many people use personal loans to consolidate high-interest credit card debt. This strategy can help simplify payments and reduce interest costs, especially if you can secure a lower interest rate on a personal loan.

Which is better for building credit: a personal loan or a credit card?

Both can help build credit, but they do so in different ways. A personal loan can diversify your credit mix and improve your score if managed responsibly. Credit cards, however, can help build a strong credit history if you make on-time payments and keep your balances low.

What are the risks of using a credit card for a large purchase?

Using a credit card for a large purchase can lead to high interest charges if you carry a balance. Additionally, it can increase your credit utilization ratio, potentially lowering your credit score. If you're not careful, this could result in significant debt.

Are personal loans cheaper than credit cards?

Generally, personal loans have lower interest rates than credit cards, especially for borrowers with good credit. However, the total cost of borrowing depends on factors like origination fees, loan terms, and your ability to repay the loan on time.

Can I have both a personal loan and a credit card?

Yes, you can have both a personal loan and a credit card. Using them together strategically can help you manage different financial needs. For example, you might use a personal loan for a large expense and a credit card for everyday purchases and emergencies.