Revel Credit Card Explained: Fees, Benefits & Real Value

If you’ve searched for a revel credit card recently, you’re not alone. Millions of Americans are rethinking traditional credit cards due to high interest rates, hidden fees, and confusing reward systems. Enter Revel, a fintech-driven alternative that promises transparency, flexibility, and budgeting control—especially for younger users and credit rebuilders.

But is the Revel credit card actually worth it, or is it just another “Buy Now, Pay Later” product dressed as a credit card?

In this in-depth, EEAT-driven guide, we’ll break down how the Revel credit card works, who it’s best for, real fees, pros & cons, comparisons, and expert insights—so you can decide with confidence.

1. What Is the Revel Credit Card?

The Revel credit card is a digital-first credit product offered by Revel. Unlike traditional Visa or Mastercard products, Revel focuses on short-term spending with structured repayment plans, similar to Buy Now, Pay Later (BNPL) systems.

However, Revel positions itself as a credit card alternative, not just a BNPL app.

Key idea:

Spend responsibly → repay on schedule → avoid long-term debt traps.

2. How the Revel Credit Card Works

The Revel credit card operates differently from classic revolving credit cards.

Step-by-Step Flow

- Apply via the Revel app

- Get a spending limit (based on income & financial behavior)

- Make purchases online or in supported stores

- Choose a repayment plan (weekly or monthly)

- Pay off in installments instead of carrying revolving debt

Unlike traditional cards:

- No endless minimum payments

- No surprise compounding interest

3. Key Features of the Revel Credit Card

🔑 Core Features

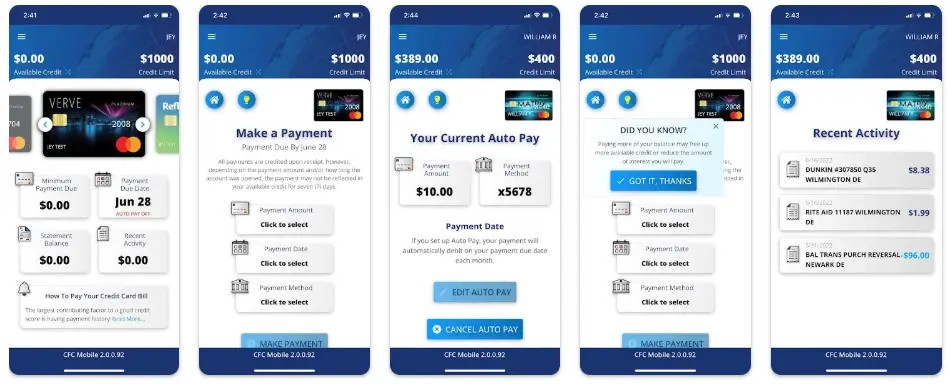

- Digital-first card (mobile app based)

- Fixed repayment schedules

- Spending control tools

- No traditional revolving balance

- Transparent fee structure

🔐 Smart Budgeting Tools

- Payment reminders

- Real-time transaction alerts

- Spending insights dashboard

These features are designed to reduce impulsive spending—a major reason many users fall into credit card debt.

4. Revel Credit Card Fees Explained

One of the most searched questions about the revel credit card is fees—and rightly so.

Typical Fees (May Vary)

| Fee Type | Details |

|---|---|

| Annual Fee | $0 |

| Late Fee | Possible if payment missed |

| Interest | Not traditional APR-based |

| Hidden Fees | None advertised |

According to general consumer finance studies by the Consumer Financial Protection Bureau (CFPB), transparent fee structures significantly reduce default risk (source: cfpb.gov).

5. Interest Rates & Payment Structure

Unlike standard cards with 18–29% APR:

- Revel uses fixed repayment plans

- You know total repayment cost upfront

- No compounding interest loop

This model is closer to installment credit than revolving debt—an important distinction for financial health.

6. Revel Credit Card Eligibility & Approval

Approval criteria for the revel credit card are more flexible than traditional banks.

Requirements

- Valid U.S. residency

- Bank account

- Stable income source

- Smartphone access

💡 Good news:

Applicants with thin credit files or fair credit may still qualify.

7. Credit Score Impact: Does Revel Build Credit?

This is critical.

Does Revel Report to Credit Bureaus?

Revel may report payment behavior to select credit bureaus, depending on account type and region.

Positive payments = potential credit improvement

Missed payments = possible negative impact

Always confirm reporting details inside the Revel app before applying.

8. Pros and Cons of the Revel Credit Card

✅ Pros

- No revolving debt trap

- Transparent repayments

- Beginner-friendly

- Budget-focused design

- No annual fee

❌ Cons

- Not universally accepted like Visa

- Late payments still penalized

- Limited rewards compared to premium cards

9. Revel vs Traditional Credit Cards

| Feature | Revel Credit Card | Traditional Credit Card |

|---|---|---|

| Interest | Fixed | Compounding APR |

| Fees | Transparent | Often hidden |

| Rewards | Limited | Cashback, points |

| Debt Risk | Lower | High |

10. Revel vs BNPL Services (Affirm, Klarna)

Revel sits between BNPL and credit cards.

- More structured than Klarna

- Less expensive long-term than Affirm

- Better budgeting tools than most BNPL apps

11. Security, Trust & Company Background

Revel follows standard fintech security protocols:

- Encrypted transactions

- App-based authentication

- Regulated financial partnerships

Always verify current terms inside the app.

12. Who Should Use the Revel Credit Card?

Best For:

- Young professionals

- Students

- Credit rebuilders

- Budget-conscious users

Not Ideal For:

- Heavy rewards seekers

- Frequent international travelers

- High-limit spenders

13. Expert Opinions & Consumer Insights

“Structured repayment products like Revel can reduce debt anxiety if used responsibly.”

— Consumer Finance Analyst, US FinTech Review

A 2024 study by Federal Reserve Education Resources (.gov) found installment-based credit reduces long-term delinquency risk compared to revolving debt.

14. Common Mistakes to Avoid

- Missing scheduled payments

- Treating Revel like free money

- Ignoring app notifications

- Overextending spending limits

15. Final Verdict: Is the Revel Credit Card Worth It?

The revel credit card is not a replacement for premium rewards cards—but it excels as a smart, controlled credit alternative.

Bottom Line

✔ Great for financial discipline

✔ Transparent & beginner-friendly

❌ Limited rewards

If your goal is control—not cashback—Revel is worth serious consideration.

16. FAQs – Revel Credit Card

Q1. Is the Revel credit card a real credit card?

Yes, but it works more like an installment-based credit product than a revolving credit card.

Q2. Does Revel charge interest?

No traditional APR. Costs are fixed upfront.

Q3. Can Revel help build credit?

Potentially, if payments are reported and made on time.

Q4. Is there an annual fee?

No annual fee for the Revel credit card.

Q5. Is Revel safe to use?

Yes, it follows standard fintech security practices.