Teens and Income Taxes: Do They Need to File?

Paying taxes is often viewed as a responsibility for adults, but what about teenagers? With many teens stepping into the workforce or earning through part-time jobs, babysitting, or freelancing, the question arises: Do teens need to file income taxes? This comprehensive guide explores the rules, exceptions, and tips to help teens and parents navigate tax obligations effectively.

Understanding Income Taxes for Teens

Income taxes apply to everyone who earns income above specific thresholds, regardless of age. While teens may not have the same financial obligations as adults, understanding when and how they should file taxes is crucial.

Why Should Teens Learn About Taxes Early?

- Financial Responsibility: Filing taxes helps teens understand money management.

- Avoiding Penalties: Not filing when required can lead to fines.

- Building Credit History: Tax compliance can be the first step toward financial independence.

When Do Teens Need to File Income Taxes?

Whether a teen needs to file taxes depends on several factors, including the type and amount of income they earned.

Income Thresholds for Teens in 2024

For the 2024 tax year, the Internal Revenue Service (IRS) has set the following thresholds:

- Earned Income: If a teen earns more than $13,850 through wages, salaries, or tips.

- Unearned Income: If unearned income (e.g., investments or dividends) exceeds $1,250.

- Self-Employment Income: Teens with net earnings of $400 or more from freelancing or business ventures must file.

- Combination of Income: If the total income (earned and unearned) exceeds the standard deduction for dependents.

Types of Income That Affect Filing Requirements

1. Earned Income

This includes wages from jobs like babysitting, fast food services, or retail. If a teen’s total earned income exceeds the standard deduction, they must file.

2. Unearned Income

Teens may have unearned income through investments, savings accounts, or bonds. Even small amounts of interest or dividends could trigger a filing requirement.

3. Self-Employment Income

The rise of the gig economy has led to more teens engaging in freelance work. The IRS considers activities like tutoring, selling crafts, or offering photography services as self-employment.

How Dependents and Taxes Are Linked

Parents often claim teens as dependents on their tax returns, which can affect the filing requirements.

Key Points to Understand About Dependents

- Teens claimed as dependents can still be required to file their own taxes if their income exceeds certain thresholds.

- The standard deduction for dependents is the greater of $1,250 or earned income plus $400, up to $13,850.

What Happens if Parents Claim a Teen as a Dependent?

Claiming a teen as a dependent:

- Reduces the parents’ taxable income.

- May limit the teen’s ability to claim deductions or credits.

Do Teens Have to Pay Taxes on All Income?

Not all income is taxable. Here’s a breakdown:

1. Taxable Income

- Wages from jobs.

- Income from freelancing.

- Tips and commissions.

2. Non-Taxable Income

- Scholarships used for tuition and fees.

- Allowances or gifts from parents.

Tax Forms Teens May Encounter

Filing taxes can be overwhelming, especially for first-timers. Here’s a quick guide to the forms teens need:

W-2 Form: Income from Employers

Employers provide a W-2 form summarizing total earnings and taxes withheld.

1099 Form: Freelance or Contract Work

Teens earning more than $600 from freelancing will receive a 1099-NEC form.

Form 1040: Individual Income Tax Return

The Form 1040 is the primary document used to file federal taxes.

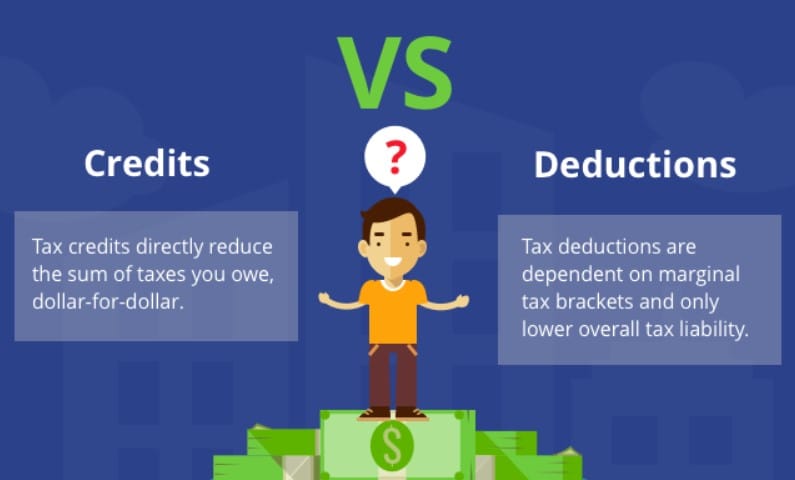

Tax Credits and Deductions for Teens

Teens, like adults, may qualify for tax credits and deductions. These reduce taxable income or taxes owed.

1. Standard Deduction

- Allows dependents to deduct the greater of $1,250 or earned income plus $400, up to $13,850.

2. Earned Income Tax Credit (EITC)

- Available for teens with earned income, though eligibility depends on income level.

3. Education Tax Benefits

- Teens paying for college may qualify for the American Opportunity Credit or the Lifetime Learning Credit.

Special Tax Situations for Teens

1. Teens with Investment Income

Investment income exceeding $2,500 may be subject to the kiddie tax, which taxes a portion of the income at the parents’ tax rate.

2. Teens in the Gig Economy

Freelancers must keep detailed records of income and expenses to calculate net earnings.

3. Teens Working Abroad

Teens working outside the U.S. may need to file international tax forms, such as the Foreign Earned Income Exclusion.

How to File Taxes as a Teen

Filing taxes may seem intimidating, but it’s a straightforward process with the right preparation.

1. Gather Essential Documents

Teens need the following:

- Social Security Number.

- W-2 or 1099 forms.

- Records of expenses for deductions.

2. Choose a Filing Method

- E-Filing: Fast and user-friendly.

- Paper Filing: Requires mailing a physical form.

3. Use Tax Software or Seek Help

Free tools like TurboTax or H&R Block assist with tax filing. Teens with complex situations may benefit from professional guidance.

FAQs About Teens and Income Taxes

What happens if a teen doesn’t file taxes when required?

Failure to file can result in penalties, interest, and even issues with future financial transactions.

Can parents and teens both claim the same income?

No. Income reported on the teen’s tax return cannot be claimed again by parents.

Are teens required to pay estimated taxes?

Teens earning self-employment income may need to pay quarterly estimated taxes.

What should a teen do if taxes are withheld unnecessarily?

Teens can file a tax return to claim a refund for overpaid taxes.

Do teens need to file state taxes?

This depends on state-specific filing thresholds and residency rules.

Can teens file taxes without parental help?

Yes, but teens often benefit from parental guidance or professional advice.

Conclusion: Empowering Teens Through Tax Knowledge

Understanding income taxes is an essential step toward financial independence for teens. By learning when and how to file taxes, teens can avoid legal issues, claim potential refunds, and build a solid financial foundation. Parents, too, play a vital role in guiding teens through this process, ensuring they grasp the responsibilities and benefits of tax compliance.