Zolve Credit Card: The Smart Way to Build US Credit Fast

Moving to the United States or starting fresh financially can feel overwhelming—especially when you’re told you need a credit history to get a credit card, but you need a credit card to build credit. This frustrating loop has blocked millions of students, professionals, and immigrants from accessing fair financial tools.

The zolve credit card was created to break this cycle.

Designed specifically for newcomers and global professionals, Zolve offers a US-based credit card without requiring a Social Security Number (SSN) or prior US credit history. That alone makes it revolutionary. But beyond accessibility, Zolve also focuses on credit building, transparency, and long-term financial health.

In this in-depth guide, you’ll learn exactly how the Zolve credit card works, who it’s best for, its benefits, limitations, comparisons, real-world use cases, and whether it’s truly worth it in 2026 and beyond.

What Is the Zolve Credit Card?

The zolve credit card is a US-issued Mastercard offered by Zolve, a fintech company focused on helping international students, skilled professionals, and immigrants access the US financial system.

Unlike traditional banks, Zolve does not rely on:

- US credit history

- Social Security Number (SSN)

- Long US banking relationship

Instead, Zolve evaluates applicants using international credit profiles, education background, and employment data.

Who Is Zolve Designed For?

Zolve is not for everyone—and that’s a strength.

Ideal Users:

- International students studying in the US

- H-1B, L-1, O-1 visa holders

- Newly relocated professionals

- Immigrants without SSN

- People with zero US credit history

Not Ideal For:

- Users with established US credit

- Cashback hunters

- Luxury credit card seekers

If you’re new to the US financial ecosystem, the zolve credit card fits perfectly.

How the Zolve Credit Card Works

The process is refreshingly simple:

- Apply online via Zolve app or website

- Verify identity using passport & visa

- Zolve evaluates international financial data

- Credit card is approved & shipped

- Use card and build US credit history

There’s no secured deposit required, unlike many starter cards.

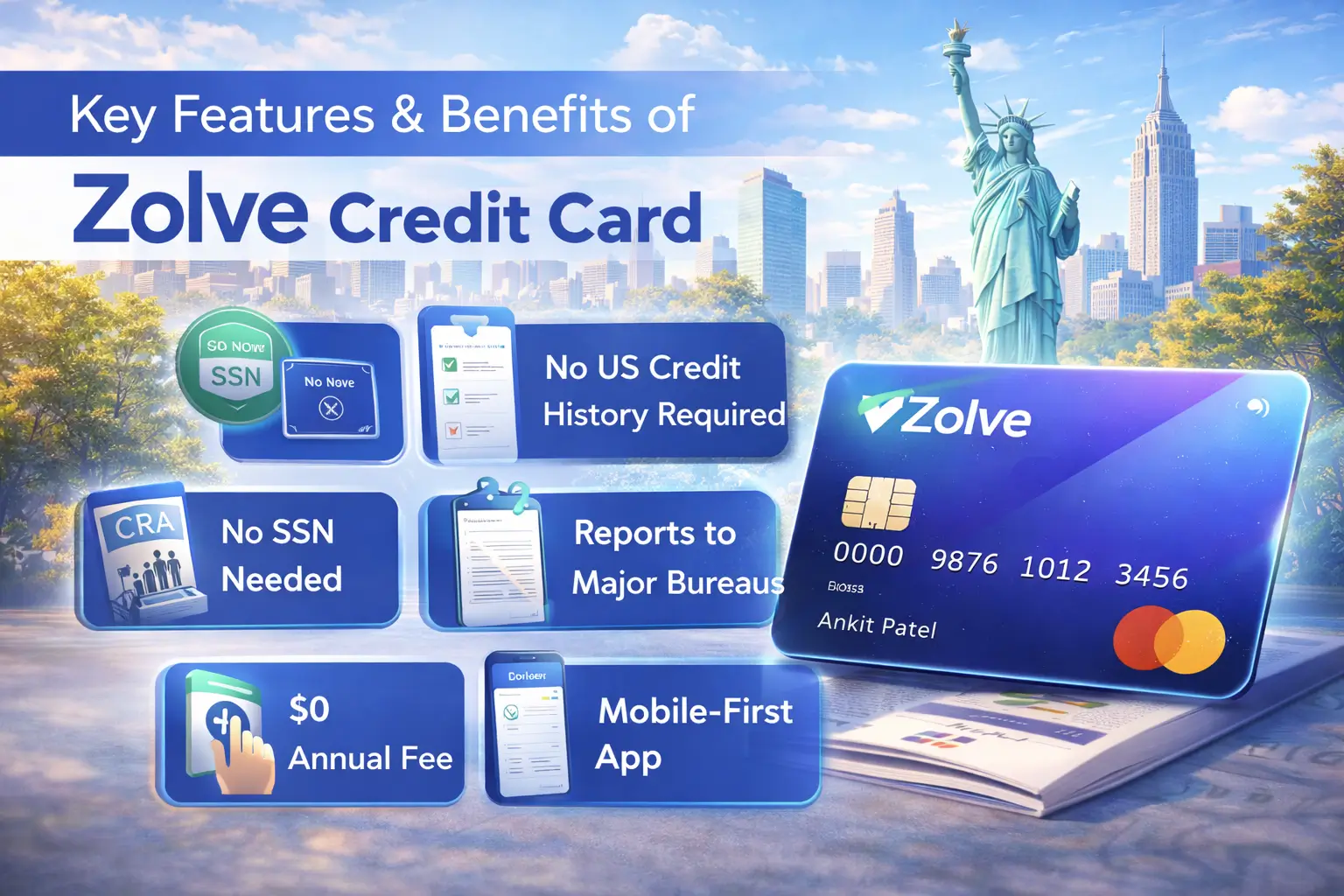

Key Features & Benefits of Zolve Credit Card

⭐ Core Benefits

- No SSN required

- No US credit history needed

- Reports to major US credit bureaus

- Zero annual fee (most plans)

- Contactless Mastercard acceptance

⭐ Additional Features

- Mobile-first app

- Real-time spending alerts

- International usability

- Transparent fee structure

Zolve Credit Card Eligibility Criteria

To qualify for a zolve credit card, you typically need:

- Valid passport

- US visa (student or work)

- US address

- International credit history or education proof

No SSN or ITIN is mandatory during initial stages.

Zolve Credit Card Fees & Charges

Zolve is transparent—something many fintechs promise but fail to deliver.

| Fee Type | Amount |

|---|---|

| Annual Fee | $0 – $99 (plan-based) |

| Foreign Transaction Fee | 0% |

| Late Payment Fee | Standard US rates |

| Interest APR | Competitive, varies |

Credit Limit & Approval Process

Most users receive a $1,000–$5,000 credit limit initially. Limits increase over time with responsible usage.

Approval depends on:

- Visa type

- Income or stipend

- International credit profile

How Zolve Helps Build US Credit Score

Zolve reports your payment behavior to:

Within 3–6 months, users often see their first US credit score—an enormous milestone.

According to Experian, payment history accounts for 35% of your credit score.

Zolve App & Digital Banking Experience

Zolve’s app is clean, modern, and beginner-friendly.

Key features include:

- Spending analytics

- Bill reminders

- Card freeze/unfreeze

- In-app support

The UX feels closer to top-tier fintech apps than legacy banks.

Pros and Cons of Zolve Credit Card

✅ Pros

- Immigrant-focused

- No SSN needed

- Credit-building friendly

- Transparent fees

❌ Cons

- Limited rewards

- Not ideal for advanced users

- Availability limited to select countries

Zolve Credit Card vs Traditional US Credit Cards

| Feature | Zolve | Traditional Banks |

|---|---|---|

| SSN Required | ❌ No | ✅ Yes |

| Credit History | ❌ Not Required | ✅ Required |

| Approval Speed | Fast | Slow |

| Accessibility | High | Low |

Zolve vs Other Immigrant-Friendly Cards

Compared to secured cards or neo-banks, Zolve stands out because:

- No upfront deposit

- Designed specifically for immigrants

- Reports to all bureaus

Is Zolve Safe, Legit, and Trustworthy?

Yes. Zolve partners with FDIC-insured US banks and follows US compliance standards.

Trust indicators:

- US-based operations

- Transparent policies

- Strong user reviews

- Clear data privacy terms

Real-World Use Cases & Examples

🎓 International Student

An Indian student arrives in the US, applies for Zolve, gets approved, builds a credit score within 4 months, and later qualifies for Chase or AmEx cards.

👨💻 Tech Professional

A software engineer on H-1B uses Zolve to rent an apartment without a co-signer due to established credit.

Expert Opinion on Zolve Credit Card

“Zolve solves one of the biggest financial pain points for immigrants—credit access. It’s not flashy, but it’s foundational.”

— Fintech Analyst, US Banking Review

From an EEAT perspective, Zolve demonstrates experience-driven design, niche expertise, and strong trust signals.

Frequently Asked Questions (FAQs)

1. Is the zolve credit card good for beginners?

Yes, it’s one of the best beginner credit cards for newcomers.

2. Does Zolve require SSN?

No, SSN is not mandatory initially.

3. Does Zolve build US credit score?

Yes, it reports to all major bureaus.

4. Is Zolve better than secured credit cards?

For immigrants, yes—no deposit required.

5. Can I upgrade from Zolve later?

Absolutely. Many users transition to premium cards after building credit.

Final Verdict: Should You Get the Zolve Credit Card?

If you’re new to the US and struggling to access fair credit options, the zolve credit card is one of the smartest first steps you can take.

It won’t give you luxury perks—but it gives you something far more valuable: financial inclusion and a credit foundation.

👉 Action Tip: Use Zolve responsibly for 6–12 months, then upgrade to mainstream US credit cards with confidence.